-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

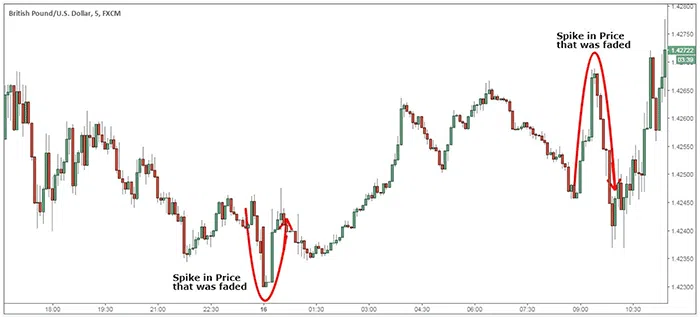

Fading a move is the unorthodox strategy of trading against the prevailing trend of the market, and can be very profitable with the right market conditions.

Fade a Move Strategy

Using this strategy, a trader will sell expecting the momentum to fade away while in an uptrend, and a trader will buy with the expectation that the move will fade away and reverse while the market is in a downtrend.

There are two main components of a Fade a Move Strategy.

Don’t Fade Strong Market Trends

Fading strong market trends is a losing game and a receipt for disaster. Fading a trend successfully is not easy because trends can continue to stay in motion for long periods.

Fade Sudden and Explosive Spikes

What we want to fade out are sudden or explosive moves or spikes in price that are unsustainable and lack the momentum to continue.

How Fade A Move Strategy Works

Most of these spikes in price happen on an intraday basis, so using a day trading strategy to fade spikes in price is best. Fading requires having a contrarian approach, and many of the most prominent hedge fund managers promote themselves as being contrarian traders.

Fade a Move Conditions & Strategy

Condition 1

The primary assumption behind fading strategies is either that the trend is overbought/oversold or the move lacks the momentum to continue.

Consolidating or ranging market conditions are the ideal trading environment to fade spikes in price. First, a trader needs to find a ranging market. Luckily, the market spends most of the time in ranging conditions, which means that this trading strategy can be used frequently.

GBP/USD trading range right before the London session opening bell

The above chart highlights the GBP/USD trading range right before the London session opening bell. For this strategy to work, a trader does not need to guess in which direction the market will spike, and instead only watch the market move naturally and react afterwards.

Condition 2

The second condition to be satisfied to fade a move successfully is that the spike in price needs to happen from significant technical level (support/resistance; swing high/low; psychological numbers).

In our case, the GBP/USD spikes down to the support level and quickly start fading away. You can either buy right away when the support level is hit or you can use a more conservative entry strategy as follows:

- Wait for the market to start fading and pulling away from the support level.

- Mark the height of the candle on your chart that started the sell-off.

- Place a buy limit order to go long once that high is broken.

Keep Risk Contained

When fading a move, keep your risk contained to prevent potential losses. Don’t forget to use a protective stop loss to minimise the possible loss in case the trade goes wrong.

- After your order gets triggered, place your protective stop loss below the support level. You can add a buffer of 5-10 pips to protect against possible false breakouts.

- The next thing you need to establish is an ideal place to take profits, which should always be at least two or three times more than your stop loss.

Conclusion

Fade trading means waiting for the initial spike in price and only trade what happens after it. The first spike is usually a knee-jerk reaction that is designed to fool many traders into jumping into the market in the wrong direction.

Even though fade trading might seem to be risky because you’re trading against the trend, it can be extremely profitable if appropriately used. This is because the market spends most of the time consolidating which is where most of the spikes in price happen.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.