-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

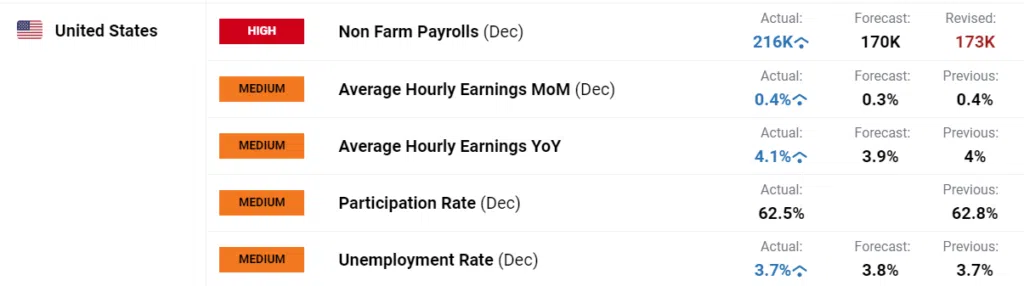

On January 5th, the EUR/USD crashed below 1.09 before recovering, after unexpectedly strong NFP data showed that the US economy created 217k jobs versus market expectations of 170k, and the unemployment rate also held steady at 3.7%.

Markets were also surprised by an increase in average hourly earnings – 0.4% versus 0.3% expected, and acceleration of yearly wage increases from 4% to 4.1%, versus estimates of a fall to 3.9%. While this is good news for workers across the US, it’s bad news for the Federal Reserve’s attempts to reduce inflation.

In volatile trading, Gold also fell back from historic highs as traders digested the probably of higher-for-longer rates, though the possibility was foreshadowed in recent days.

Markets closed out 2023 with high expectations for an aggressive series of rate cuts this year. But on Wednesday, January 3rd, the US Federal Reserve published the minutes of the FOMC’s December meeting – where the Fed left rates unchanged and indicated that they would make three quarter-point cuts in 2024. Markets responded jubilantly, with commentators discussing the end of the central bank’s war on inflation and hoping for a rate cut as soon as March.

But the minutes of the meeting told a different story. Most Fed policymakers wanted to keep rates higher for longer. While officials still viewed rates as “as likely at or near [their] peak”, they also saw “an unusually elevated degree of uncertainty” in this year’s economic outlook. Most FOMC members would want to see more evidence inflation was moving towards their 2 per cent goal before loosening monetary policy.

The news sent the USD, as represented by the DXY index, on a two-day bull run and piled pressure on the EUR/USD. For its part, the eurozone has been under increasing pressure to lower rates in recent weeks as indicators show that growth in the EU remains tepid and business confidence is low. Concerns that the European Central Bank´s monetary policy has been overly restrictive have grown.

With the latest NFP data now further supporting the notion that the Fed will keep rates elevated for some time, the EUR/USD will remain under continued pressure and the DXY will remain bullish. Gold prices, already in uncharted territory will also struggle. CPI data will be released on Thursday and any increase in inflation will only further increase the possibility of a hawkish policy response.

In 2023, central banks adopted a data-driven monetary policy, with reactionary responses to unexpected numbers sometimes whipsawing the market. It seems 2024 has picked up right where 2023 left off.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.