-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

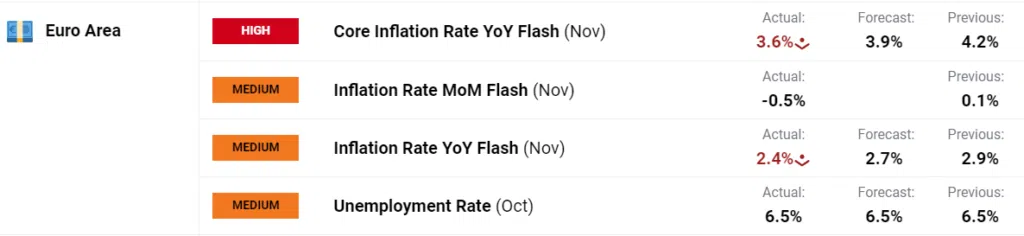

Data showed that inflation in the eurozone fell far more than expected in November, down to 2.4% from 2.9% in October and much lower than the expected readout of 2.7%.

Simultaneously, data from Germany and Italy showed a small uptick in unemployment rates, further raising concerns over a wider EU slowdown.

The market reaction was immediate, with the EUR/USD plummeting from 1.09800 to 1.09100. Market analysts also moved forward their expected date for when the European Central Bank (ECB) will start cutting rates, to as early as next April.

The economic data seemed to run counter to recent statements from ECB President Christine Lagarde, who had warned on Monday that it was “not the time to start declaring victory” and that “headline inflation may rise again slightly in the coming months”.

But with US inflation also falling – though exactly as forecast – and intense pressure on the Federal Reserve to start cutting rates as early as possible next year, the outlook for the EUR/USD is hard to predict.

Markets have currently priced in a cut to US interest rates in March 2024, and this week members of the Fed’s FOMC have spoken openly about inflationary pressures receding and the need to bring borrowing costs down to support the economy.

In a further twist, the OECD´s latest economic outlook, published on Wednesday, 29 November, predicted that the ECB will not start cutting rates until 2025 and that markets were wrong to expect a cut before then.

So, in the whirlwind of data, forecasts, and statements, where to now for the EUR/USD?

In the short term, the EUR will remain under pressure, especially after its bull run since the beginning of October. With monetary policy support for either currency now unlikely, traders will be closely studying policymaker statements and wider economic data. As long as data shows continued economic weakness in the EU, and the US economy in rude health, the USD should retain the upper hand.

Of course, as has been the case all year, any unexpected upturn in inflation on either side of the Atlantic would radically alter the equation.

In the medium term and into the new year, things look more complex. On balance, with the Federal Reserve under more political pressure than the ECB to start cutting rates, I expect the USD to lose some of its lustre.

This will be doubly true if the OECD is right, and the ECB favours retaining the status quo until 2025 – a highly unlikely scenario. In that case, the potential downside for the USD is huge.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.