Bull flags are multi-candlestick patterns that occur frequently on the charts and have a high probability of success. In this video, Alison shows you how to identify bull flag patterns and provides two bull flag trading strategies.

Understanding the Bull Flag Pattern

- Overview: In this video, I will discuss the bull flag pattern, a highly effective trading pattern that can significantly enhance your trading arsenal.

Characteristics of a Bull Flag Pattern

- Definition: A bull flag is a continuation pattern that typically appears after a pause in an uptrend, signaling a potential movement higher.

- Application: This pattern is versatile, and applicable across all instrument classes and timeframes.

Trading Strategies Involving Bull Flags

- Long Positions: The bull flag can indicate holding your long positions open.

- Short Positions: It may also suggest closing short positions.

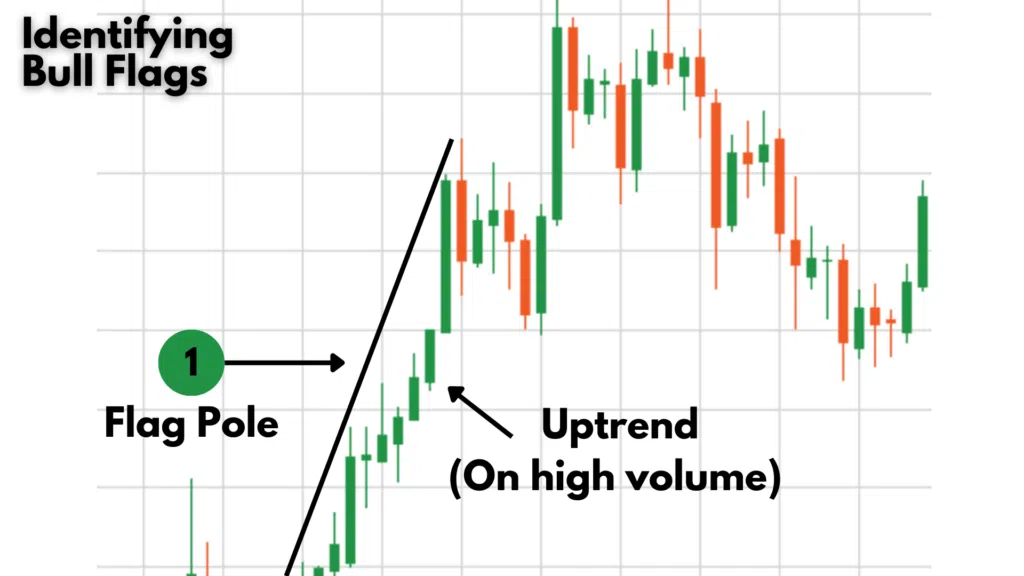

Identifying a Bull Flag

- Complexity: Identifying a bull flag can be complex due to its multiple components.

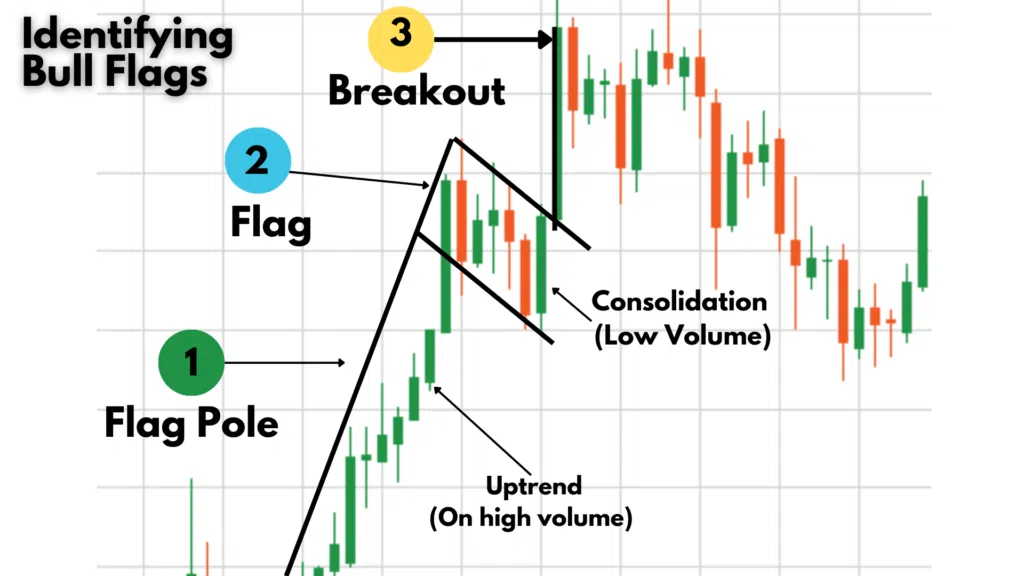

- The Pole: First, there’s the pole, representing the uptrend, usually occurring on high volume.

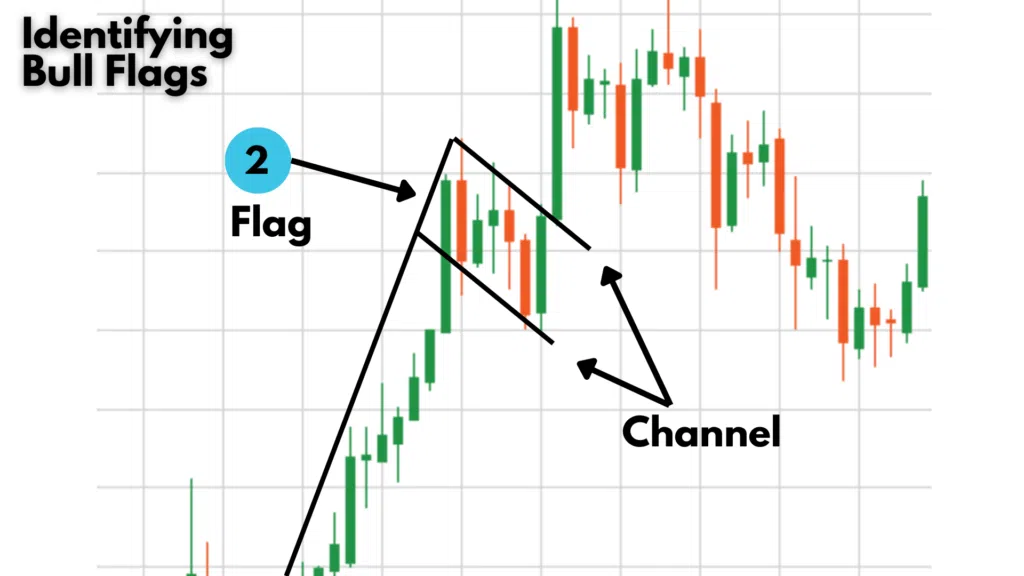

- The Flag: Then, the flag shows consolidation or a slight downward slope, fitting between two channel lines or trend lines on low volume.

- Retracement Criteria: The flag is considered valid if the retracement does not exceed 50% of the pole, ideally being less than 38% of the original trend.

- Breakout: The breakout above the flag, signalling the continuation, is measured by the length of the pole and occurs at high volume.

Techniques to Identify Bull Flags

- Trend Line Use: Connect the bottom of the pole to the top using a trend line.

- Channel Tool: Employ the channel tool to define the flag, which can have a slight lean or be horizontal.

- Practice: Practice identifying bull flags on a demo account and conduct backtesting.

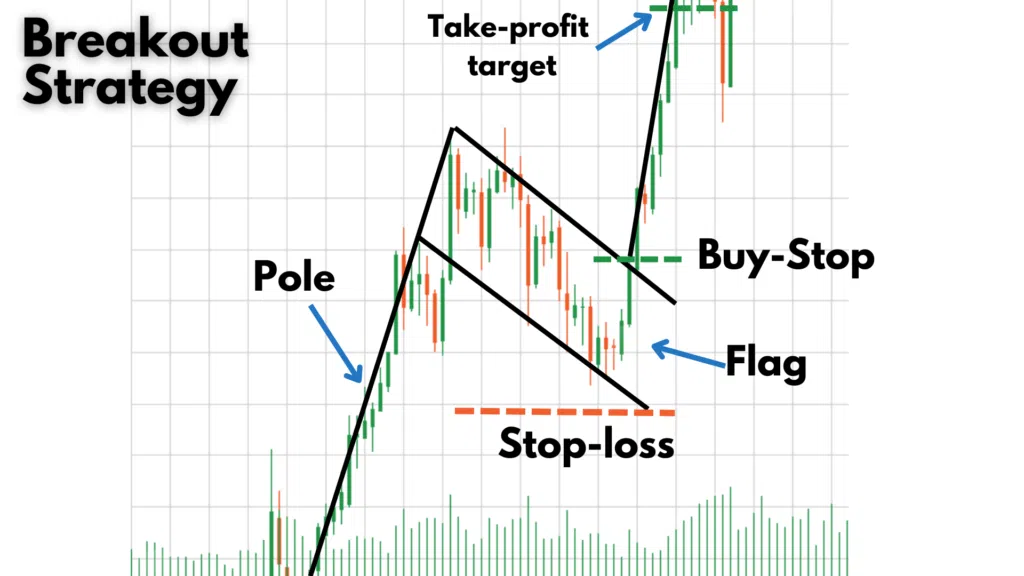

Break Out Strategy: Trade based on the breakout strategy.

- Entry Point: Enter at the closure of the first candle that breaks above the trend lines.

- Order Placement: Create a buy-stop order above the top trend line of the flag and place a stop loss below the bottom channel line.

- Target Setting: The target could be roughly the length of the flagpole or use a 1 to 2 risk-reward ratio.

Important: Always manage your risk correctly, employing stop losses and taking profits.

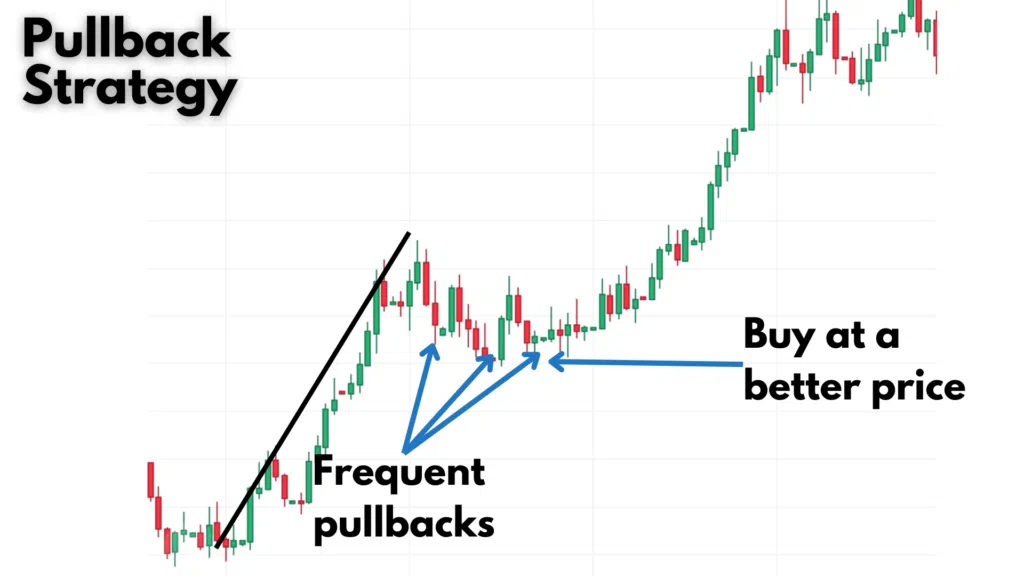

Pullback Strategy

- Complexity: This strategy is more challenging due to the timing.

- Market Dynamics: Use pullbacks in the market to buy at better prices and improve your risk-reward ratio.

- Technical Tools: Utilise tools like the Fibonacci retracement tool for better entry points.

- Entry and Exit: Buy on the retest of the support line and set stop losses below the bottom trend line or support level.

- Complementary Techniques: Use other technical indicators and fundamentals to support your analysis.

Pros and Cons of Trading the Bull Flag

- Pros: Predicts continuation across all instruments and timeframes and provides concrete market entry and exit points.

- Cons: Interpretation of flag length can vary among traders, potential conflict with reversal indicators, and pattern may appear overbought yet continue higher.

Conclusion

- Please ask questions regarding bull flags or other trading patterns below or on Instagram or Facebook.

Disclaimer: This transcript was created with AI assistance