-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

SARB pivoted away from market expectations today, raising the interest rate by .5% and citing currency weakness.

The financial world is nervous, all eyes on the incessant partisan bickering between the Republican-controlled Congress and the Biden Presidency. The risk of a US default is very real, and the USD is riding high against both major currencies as traders seek a safe haven. The strength of the USD has also put further pressure on the rand, which slipped to a new all-time low against the USD last week following allegations of arms smuggling. The ongoing saga of the Lady R and its alleged consignment of weapons bound for Russia is just the latest in a series of blows to investor sentiment in South Africa.

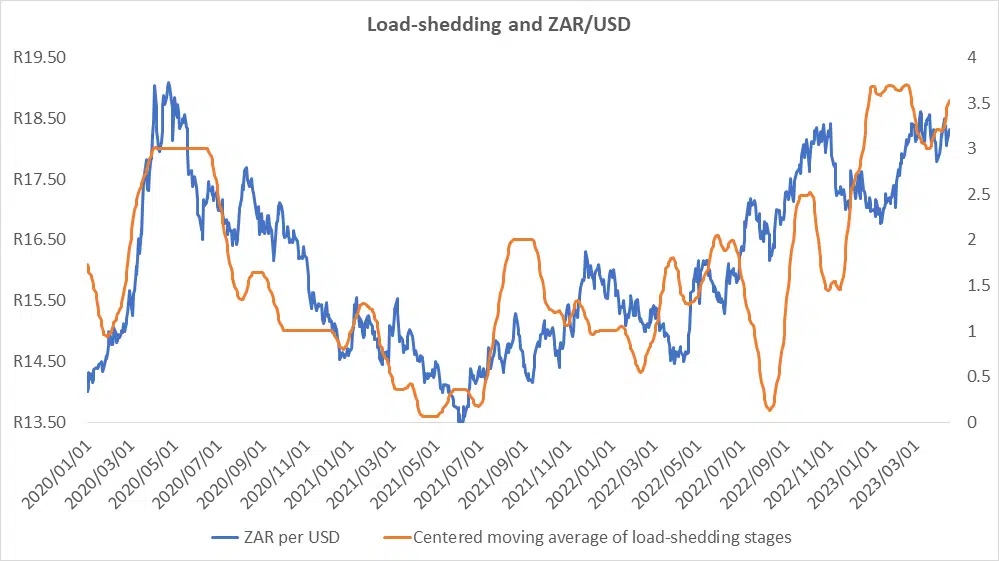

Underpinning the rand’s steady decline is the ongoing energy crisis, with mixed signals from the ANC this week only intensifying investor wariness. ANC secretary-General Fikile Mbalula said earlier this week that load-shedding would stop by the end of 2023. But the Minister of Electricity, Kgosientso Ramokgopa, almost immediately contradicted this assertion, saying that load-shedding will remain for the foreseeable future. Rumours abound of 12-hour blackouts by Christmas.

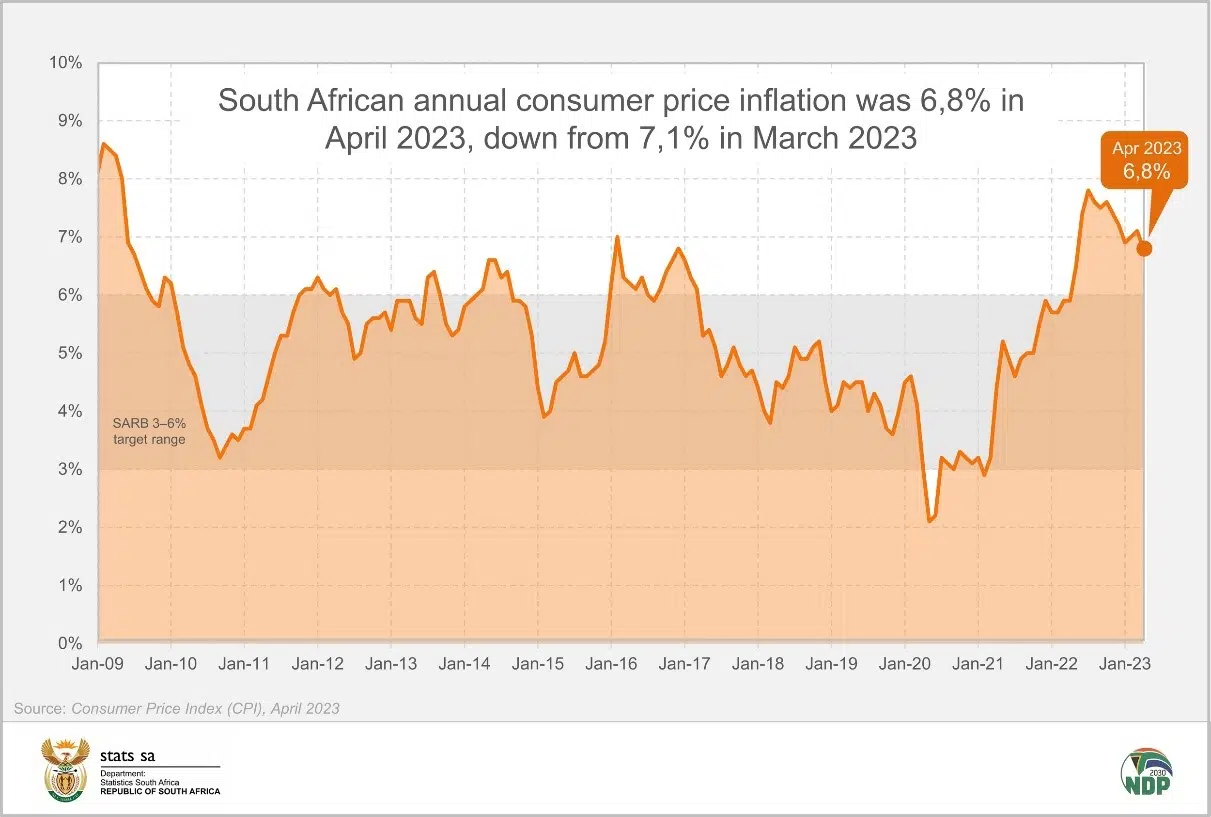

Analysts have noted the strong correlation between the intensity of load-shedding and the ZAR/USD exchange rate. As load-shedding increases, the ZAR weakens and vice versa. So, despite market expectations, it was no great surprise that SARB raised interest rates by .5%. Though with inflation figures coming in lower than expected on Wednesday, the hawkish stance by SARB increases the risk of a harder downturn in the near future.

Lower prices for key commodity exports because of China’s slow recovery, a looming recession and the grey listing of South Africa by the Financial Action Task Force offer more reasons to be bearish on the outlook for the rand and economic growth more generally.

The gloom has also weighed heavily on the JSE, with no fewer than 48 stocks hitting new 52-week lows since last Monday.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.