-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

INFINOX Broker Review

Last Updated On May 8, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Infinox

With two low-cost accounts, a good range of Forex pairs, excellent market analysis materials, and good trading tools, INFINOX is a decent all-around broker. INFINOX has held a licence from the South African FSCA since 2021, but we were disappointed to find that South African residents are deprived of local regulation and are onboarded through INFINOX’s Mauritius-based entity instead.

INFINOX offers traders the choice of a commission-free STP account or a commission-based ECN account, both with a minimum deposit of 1 GBP (or currency equivalent). Trading costs range between 8 – 9 USD per lot traded, much lower than average for the industry. Trading is available on both the MT4 and MT5 platforms, and INFINOX also offers a great social trading app, especially good for beginners starting their trading careers.

As well as the lack of FSCA protection, we were unhappy with the lack of transparency regarding withdrawal fees, despite the wide range of local funding methods. We were also disappointed by non-responsive customer support and INFINOX’s weak FAQ section.

| 🏦 Min. Deposit | GBP 1 |

| 🛡️ Regulated By | SCB, FCA, FSC, FSCA |

| 💵 Trading Cost | USD 8 |

| ⚖️ Max. Leverage | 1000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Low minimum deposits

- Excellent Market Research

Cons

- Non-responsive customer support

- Extreme leverage

- Limited base currencies

Is INFINOX Safe?

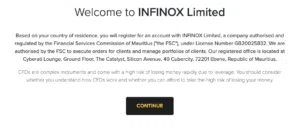

We were disappointed to find that although the South African FSCA regulates INFINOX, South African traders are onboarded through INFINOX’s Mauritius-based entity.

No FSCA protection: Although INFINOX maintains an FSCA licence, it onboards South African clients through its Mauritius-based entity. This is disappointing for South African traders as it means that they will not benefit from local regulation, and their money will not be segregated at South African banks. It also means that in the event of a dispute with INFINOX, South Africans will have little recourse through the FSC regulator. See below for INFINOX’s sign-up notice:

Safety Features: While the lack of FSCA oversight may be a concern for some South African traders, INFINOX does have a good reputation, and its UK operation is overseen by the FCA – one of the world’s top regulators. It also provides all clients with negative balance protection, meaning traders cannot lose more than their initial deposit.

Company Details:

![]()

![]()

We confirmed each of the licences and regulations on the regulator’s online register. See below for details of INFINOX’s FSC-regulated entity:

INFINOX’s Financial Instruments

We were dissatisfied with INFINOX’s instrument range, especially the low number of stock CFDs, but it offers 49 Forex pairs and 1000:1 leverage.

Full List of Instruments and Leverage:

Forex pairs: With over 49 pairs available for trading, INFINOX offers a decent range of Forex pairs. It also offers much higher leverage – up to 1000:1 on the majors.

Cryptocurrencies: INFINOX offers a good range of crypto crosses, including Bitcoin, Ethereum, Litecoin, Ripple, and other specialty cryptocurrencies. The maximum leverage is 1:33, which is higher than many other brokers. However, traders should know that trading with this type of leverage on such a volatile asset is risky. It can lead to increased profits but also big losses.

Metals: INFINOX offers 6 metals, including silver and gold crosses with the USD.

Energies: INFINOX offers spot contracts on both Brent and WTI oil; this is a slightly limited range compared to other brokers.

Indices: INFINOX offers CFDs on various international indices, including the NASDAQ, S&P500, FTSE100, DAX30, and the Nikkei – a similar range of indices compared to other brokers.

Share CFDs: An unspecified number of equity CFDs exist, but, given the math, the total must be around 150, considering the 300+ assets mentioned on INFINOX’s website.

Overall, INFINOX has fewer instruments to trade than most other brokers, which may leave some traders dissatisfied.

INFINOX’s Trading Accounts

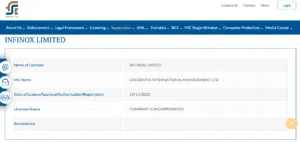

Like many other brokers, INFINOX gives traders the choice of a commission-free account and a commission-based ECN account.

Trading Fees: Clients may choose either the commission-free straight-through processing (STP) account or a commission-based electronic communication network (ECN) alternative. As per INFINOX’s FAQ section, the minimum deposit amount is 1 GBP or equivalent in your base currency. Fees are around 8-9 USD per lot traded on both accounts.

Account Trading Costs:

![]()

![]()

As you can see from the table above, trading costs on the ECN account are marginally lower than those on the STP account, and these fees are similar to those of other good brokers.

STP Account: The STP Account requires a minimum deposit of only 1 GBP (or currency equivalent), and no commissions are charged for Forex trading. Spreads average at 0.9 pips (EUR/USD), and leverage is up to 1000:1 for Forex trading.

ECN Account: The minimum deposit is also 1 GBP, and spreads average at 0.2 pips (EUR/USD) in exchange for a commission of 6 GBP/EUR/USD (round turn). Leverage on the ECN account is also up to 1000:1.

Deposits and Withdrawals

Although we were pleased to find that INFINOX offers more account funding methods than other brokers, it does not publish any information about its fees or the processing times on its website.

Like most brokers, INFINOX does not allow funding to or from third parties. Therefore, all withdrawal requests from a trading account must go to a funding source in the trader’s name.

Accepted Deposit Currencies: South Africans will be disappointed that INFINOX only allows trading accounts to be denominated in EUR, USD, GBP, and AUD. Always check the exchange rate when converting from ZAR to other currencies, as hidden conversion fees can make trading expensive and affect profitability.

Deposits and Withdrawals: We were disappointed that INFINOX does not publish any information regarding the fees associated with depositing or withdrawing funds.

The Legal Documents state that “INFINOX may charge for incidental banking-related fees such as wire charges for deposits/withdrawals. INFINOX reserves the right to change its fee structure and/or parameters at any time without notice. Fees do not currently but may in the future include such things as statement charges, Order cancellation charges, Account transfer charges, telephone order charges, or fees imposed by any interbank agency.”

According to customer service, INFINOX does not charge a withdrawal fee. Clients

can withdraw funds from their INFINOX account at any time, day or night, and withdrawals are processed on the same day. We recommend checking the fee structure with customer service before depositing funds.

Traders should also be aware that to make a withdrawal, they must submit a request either in writing, by telephone, or by email.

See below for a list of payment methods:

- Bank Wire

- Astropay

- Credit Card

- Dusupay

- Finrax

- Mifinity

- Neteller

- OZOW

- Perfect Money

- Skrill

- Sticpay

- Swiffy Pay

- Zotapay

We tested deposits and withdrawals in ZAR via a Visa credit card and found that our deposit was processed almost instantly, and it took 2 days for our withdrawal to arrive in our account. This withdrawal time is around the industry average.

INFINOX’s Mobile Trading Apps

With both MT4 and MT5 available, INFINOX’s mobile trading platform choices are average compared to other brokers.

MT4 and MT5 Mobile Trading

The MT4 and MT5 trading platforms are available on both Android and iOS mobile devices and tablets. While most of the desktop features are available, there is some loss in functionality, including reduced timeframes and fewer charting options.

Other Trading Platforms

Like its mobile trading platform support, INFINOX offers support for MT4 and MT5.

MT4 and MT5

The main benefit of using third-party platforms such as MT4 and MT5 is that traders can keep their customised versions of the platforms should they choose to migrate to another broker. Both MT4 and MT5 are available for Windows, Android, iOS, and web browsers.

Overall, INFINOX’s platform support is about average when compared to other brokers. Additionally, MT4 and MT5 are generally more difficult to set up and are less user-friendly than the web-based platforms available at some other brokers.

INFINOX’s Social Trading

INFINOX also offers a social trading app, IX Social. The app is essentially a trading portal that allows you to link your MT4 or MT5 accounts, and follow or copy the trades of more experienced, successful traders for a small fee per traded lot. In the Discover tab, you will find traders in the Spotlight or Top Live Traders. You can either copy or follow these traders. Their positions will be copied automatically. The copy trading service is user-friendly and well-designed.

|  |  |

Platform Overview

![]()

![]()

Opening an Account at INFINOX

The account opening process at INFINOX is hassle-free, and accounts are ready for trading in one day.

All South African residents are eligible to open an account at INFINOX.

Creating an account is straightforward, the process is fully digital, and accounts are available for trading within one day:

New traders will have to click on the “Sign Up” button at the top of the page, where they will be directed to register an account.

- INFINOX’s intake form requires clients to register an account with a name, email address, country of residence, and telephone number.

- New traders will be sent a link via email to confirm their registration.

- Traders then need to select their preferred account type and platform (MT4/MT5).

- Once this step is complete, traders must send support documentation to complete the KYC process. These include:

- Proof of Identification – INFINOX accepts all government-issued identification documents such as passports, national ID cards, driving licenses, or other government-issued IDs.

- Proof of Address – Proof of residence/address document must be issued in the account holder’s name within the last 6 months. It must contain a trader’s full name, current residential address, issue date, and issuing authority.

- We advise that you read INFINOX’s risk disclosure, customer agreement, and terms of business before you start trading.

Once our documentation had been submitted, our account was ready for trading within 8 hours, which is around the industry average.

INFINOX’s Trading Tools

With VPS services and Autochartist, INFINOX’s trading tools are average compared to other brokers. We were disappointed to find that INFINOX does not have an Economic Calendar.

- VPS Services: INFINOX offers VPS services for all traders, but it is unclear what the conditions are for using these services. A Virtual Private Server (VPS) is a remote terminal solution that benefits from reduced latency and downtime, unaffected by power cuts or computer crashes. Even when the trading terminal is closed, the INFINOX VPS will keep trading.

- Autochartist: INFINOX also supports Autochartist, the industry-standard trading signals provider. Autochartist provides traders with automated alerts for opening and closing trades, a volatility analysis tool that allows you to optimise take-profit and stop-loss levels better, and integrated market reports. Autochartist is available on both MT4 and MT5. Unfortunately, it is unclear whether an extra fee is attached to using Autochartist.

Trading Tools Overview:

![]()

![]()

Education

INFINOX’s education is limited compared to other large international brokers.

On the INFINOX website, traders will come across a tab labelled ‘IX Intel.’ This section is divided into Research, Education, and In the Press. The education section is essentially a blog-style repository of materials with little structure, but there is a section that covers Forex and another for trading platforms. We also couldn’t find many materials that cater to more experienced traders. That said, the articles are in-depth and comprehensive.

IX Premium is only available for traders who deposit over 1000 USD. In addition to what is available in the education and research sections, traders can access one-on-one sessions, webinars, and a monthly investment report.

Education Comparison:

![]()

![]()

Research

INFINOX provides an excellent selection of market research materials.

Most of the research content is presented in the analysis blog, which is updated daily with thoughtful insight on recent and future events across a range of CFD markets. The research is further divided into various sections, including:

- Latest Market News

- Espresso Morning Call

- Market News

- Financial Data Commentary

- Forex

- Indices

- Commodities

The materials are comprehensive, detailed, in-depth, and on par with some of the large international brokers.

Customer Service

Like many other brokers, INFINOX’s customer support is available 24/5, but the customer service agents are largely unresponsive.

INFINOX’s customer support is available via live chat, email, and telephone in 15 different languages. We tried contacting customer service via live chat and had no response for a whole day. This is a big downfall for the broker because beginner traders will likely have many questions regarding the different platforms, account queries, and deposits and withdrawals.

Safety and Industry Recognition

Regulation: Founded in London in 2009, INFINOX is a relatively new Forex and CFD broker. It is regulated by several authorities, including the UK’s FCA, the SCB of Bahamas, The FSC of Mauritius, and the FSCA of South Africa. See below for more details:

- INFINOX Capital Ltd is authorised and regulated by the Financial Conduct Authority under Registration Number 501057.

- INFINOX Capital is a registered trading name of IX Capital Group Limited, authorised and regulated by the Securities Commission of The Bahamas (‘the SCB’) under Registration Number SIA F-188.

- INFINOX Limited is authorised and regulated as an Investment Dealer by Mauritius Financial Services Commission (FSC) under License Number GB20025832.

- INFINOX Capital Ltd SA is an authorized Financial Services Provider and is regulated by the Financial Services Conduct Authority under FSP No 50506 (INFINOX Capital Ltd SA acts as an intermediary for INFINOX Capital, which is Authorised and Regulated by the Securities Commission of the Bahamas.) INFINOX is a trademark belonging to INFINOX Capital Ltd, a registered company in the United Kingdom under company number 06854853.

Awards

INFINOX has won numerous awards; recent ones include:

- 1000 Companies to Inspire Britain, 2020, London Stock Exchange Group

- Best Trading Account Margin Rates 2020, Professional Traders Awards

- 2020- Broker of the Year, Global 100

- 2021 – Most Trusted Broker Asia

- 2021- Best Forex Introducing Broker Programme, Global Forex Awards 2021 – Retail

- 2021- Best Forex Copy Trading Platform, Global Forex Awards 2021 – Retail

- 2021- Best CFD Broker UK 2021, Global Forex Awards 2021 – Retail

- 2021- Best Forex Copy Trading Platform, World Business Outlook Awards

- 2021- Best FX Broker, Dubai Forex Expo

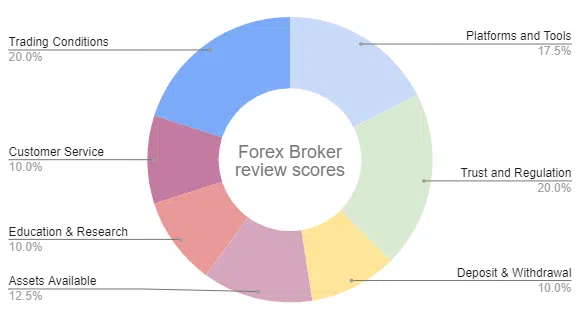

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker, the platform offering of the broker, and the trading conditions offered to clients, summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

INFINOX Disclaimer

Trading Forex is risky, and each broker must detail how risky the trading of Forex CFDs is to clients. INFINOX would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83.14% of retail investor accounts lose money when trading CFDs with INFINOX. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Final Word

INFINOX will be a difficult choice for many South African traders. On the one hand, it has low trading costs, a great social trading service, excellent market analysis, and a decent range of Forex pairs.

On the other hand, INFINOX’s South African traders will be onboarded through the FSC in Mauritius, despite INFINOX being regulated by the South African FSCA. It also lacks transparency regarding non-trading fees like deposits and withdrawals, and we found its customer service to be largely unresponsive.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Infinox stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.