-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Oinvest Broker Review

| 🏦 Min. Deposit | USD 250 |

| 🛡️ Regulated By | None |

| 💵 Trading Cost | USD 22 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Forex, Indices |

Last Updated On May 8, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Oinvest

Due to the number of complaints we have received from clients of Oinvest, we have chosen not to recommend them to visitors of this website. We suggest that traders continue their search with other FSCA regulated brokers, or our list of best Forex brokers in South Africa.

Oinvest is a South African market maker broker and was founded in 2012. It was regulated by the FSCA but had their FSCA license withdrawn in October 2020 following numerous public complaints.

| 🏦 Min. Deposit | USD 250 |

| 🛡️ Regulated By | None |

| 💵 Trading Cost | USD 22 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- ZAR Accounts

- Wide range of assets

Cons

- Local regulation only

- High minimum deposit

- Limited education

- Limited market analysis

Is Oinvest safe?

No. As of October 16, 2020, Oinvest as the trading name of Basfour3773 (Proprietary) Limited had their license removed by the FSCA (licence: 42020). For more information read the supplied article on IOL published October 16, 2020 – https://www.iol.co.za/personal-finance/guides/fsca-withdraws-the-license-of-basfour-48b0b35c-cfeb-4ee2-9006-c6f4a33c14c1. Visit our page on the best FSCA regulated brokers to continue your search.

Oinvest for Beginners

Oinvest has a comprehensive education section that includes videos, eBooks, articles and platform tutorials. Though Oinvest lacks analysis material, its educational offering is combined with responsive customer service via email, phone and live chat.

Educational Material

Oinvest’s educational material is split into three sections:

- Video on Demand (VOD) – In the VOD section you will find a wide selection of short videos (ranging from 30 seconds to a few minutes) covering the basics of trading, trading terms, trading strategies, technical analysis, Metatrader usage and much more. For those who prefer to engage with their content in a video format, the VOD section is an excellent resource, and all the VOD is available to non-account holders.

- eBooks – In the eBook section you will find four books covering the basics of Forex trading, advanced Forex trading and two other books dedicated to Commodities and Futures and CFDs and Stocks – the first few pages of each eBook are available to non-account holders but for full access you will need to open an account with Oinvest.

- Tutorials – The Tutorials section offers three tutorials in a structured format on Trading Tools, Commodities and Futures Contracts and Metatrader. Much like the eBooks, these are only fully accessible for Oinvest account-holders.

- Webinars – Oinvest holds regular webinars for clients on various aspects of Forex trading,

In addition to these three sections, there is also a small selection of courses for new traders and a few short articles on major themes in the local Forex industry, such as the USDZAR pairing over the course of 2018.

Analysis Material

Unlike many of Oinvest’s international competitors, this broker does not offer any regular Forex analysis material for customers.

Customer Support

Customer support is available by phone, email and live chat five days a week from 10am-8pm GMT.

Trading Conditions

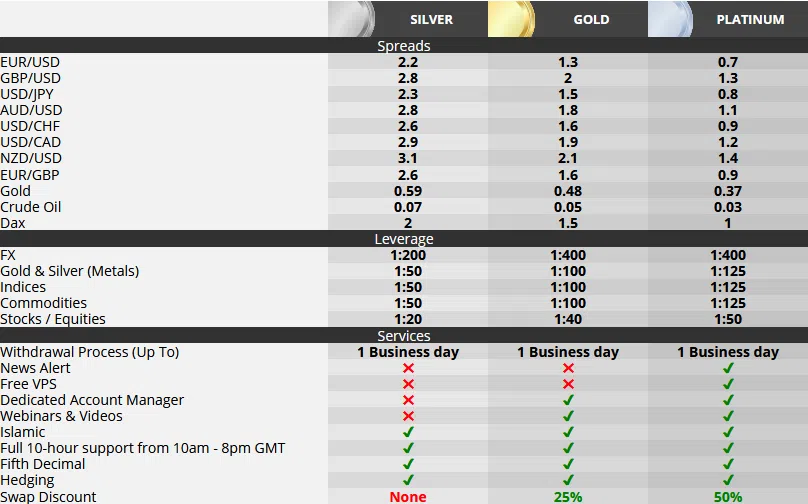

Though there is only a single account type at Oinvest, and the minimum deposit is 250 USD or ZAR equivalent. Though there is only one account type, there are three account tiers – Silver, Gold and Platinum.

Trading conditions in each tier vary depending on the level of activity and size of the investment, though what level of activity and investment is needed to move between the tiers is dependent on your knowledge, experience and is agreed upon with your account manager.

Be aware that Oinvest is market-maker broker so will be the counterparty to any trade you make.

Account Types

As mentioned above, Oinvest offers a single account type with three tiers. A demo account is also available.

Demo Account – A demo account is available for new traders and will remain open indefinitely – you can choose between USD and ZAR as your base currency and will have up to 5 million currency units to play with.

Live Account – The three tiers of live account have quite different trading conditions and features but all are available as Islamic accounts. The only wallet currencies available are ZAR and USD. As mentioned earlier, Oinvest has no fixed level of deposit or activity to achieve each tier. The main publicised differences are outlined below:

- Silver Tier: The main difference between the Silver Tier and the others is the wider spreads and leverage of only 1:200. You will receive this account tier automatically at sign-up if you do not make a deposit.

- Gold Tier: With the Gold tier you will have access to tighter spreads and leverage of 1:400, but you will also be given a dedicated account manager and a swap discount of 25%

- Platinum Tier: While leverage remains at 1:400, the spreads tighten further in this tier. A free VPS service is also offered as well as a swap discount of 50%

Spreads and Commissions

In all three tiers about 50 currency pairs are available to trade, with spreads ranging from 0.7 pips in the Platinum tier for EUR/USD to 3.1 pips in the Silver tier for NZD/USD. As a market maker broker, Oinvest’s fees are made through the spread and no commission is charged.

Deposit and Withdrawal Fees

Oinvest takes deposits via debit/credit card, EFT and PayFast and all deposits are made available within one business day. For withdrawals, Oinvest policy is to send funds back to the source of the original deposit. Withdrawals can take up to seven business days but no fees are charged.

Trading Platforms

Oinvest supports MetaTrader4 (MT4) and the associated web and mobile applications. MT4 is the industry leader and the most common trading platform for CFD traders. There are many advantages of signing up with an MT4 broker and using MT4 for trading:

- The MT4 community is vast, as is the amount of the text and video resources to support both new and experienced traders.

- The MT4 EA (Expert Advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, so a new device or computer is not necessary to get started.

Trading Tools

Oinvest does not offer traders any bespoke trading tools but as they use the MT4 platform there are a number of trading tools to take advantage of. Key features offered by MetaTrader 4 at Oinvest include:

- Broad Technical Analysis – Traders can envision a complete scenario with 9 timeframes and 30 indicators, helping recognise trends and establish ideal entry and exit points.

- Easy Execution Orders – Traders have access to three execution modes including Instant Execution, as well as 2 markets, 4 pending and 2 stop orders. In addition, a trailing stop feature is available, as is the ability to open trades directly from the built-in tick chart.

Mobile Trading Apps

MetaTrader4 (MT4) is also available on IOS, Android and Windows mobile phone and tablets. The app will connect to the same account as the desktop software, keeping the trading experience synchronised, and traders mobile.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Oinvest offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Oinvest Risk Statement

Trading in financial instruments like these may result in you losing or making money. The past performance of the financial instruments does not guarantee future results. Trading in derivatives (e.g. options, futures, and swap contracts) could result in the loss of the entire capital amount that you invested. Forex, CFDs and Derivatives are leveraged products and involve a high level of risk. Trading in leveraged instruments can result in you losing your money, however, you cannot lose more than the money that you invested as capital. You must make sure that you fully understand the risks involved. You must seek independent advice if necessary. This advice must take into account your investment objectives and level of experience. You should not invest more money and therefore risk more money than you are prepared to and can afford to lose. You should never invest and place at risk any money set aside for medical or other emergency funds, retirement savings, funds reserved for purposes such as homeownership or funds required to meet your living expenses.

Overview

Oinvest is a local South African broker regulated by the FSCA and recognised by the wider Forex industry. Though a new addition to the South African Forex market Oinvest has grown rapidly due to their adoption of the widely used MT4 platform and comprehensive educational material. Though a market-maker broker, Oinvest offer tight spreads and high leverage with no minimum deposit for new customers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Oinvest stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.