-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Valutrades Broker Review

Last Updated On April 26, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Valutrades

Established in 2012, Valutrades is a well-regulated ECN broker focusing on providing an optimal trading environment for serious beginners and more experienced traders.

Valutrades only offers a single live account and a limited range of tradable assets. Nonetheless, with one single account, Valutrades offers trading on various instruments, including over 80 Forex pairs, commodities, and indices. Valutrade’s trading conditions are excellent, with spreads starting at 0.10 pips in exchange for a commission of 3 USD per lot per side and no minimum deposit requirement. With support for MT4 and MT5, experienced traders will appreciate the range of tools available, including various technical and sentiment indicators.

Overall, Valutrades is a reasonable choice for serious beginner traders and more experienced Metatrader users looking for a new broker.

| 🏦 Min. Deposit | USD 5 |

| 🛡️ Regulated By | FCA, FSA-Seychelles |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Great platform choice

Cons

- Limited account options

Valutrades’ Overall Rating

Valutrades is a well-regulated ECN broker, ideal for serious beginners and experienced traders. Its unique selling point is tight spreads starting at 0.10 pips, complemented by a low commission of 3 USD per lot per side, with no minimum deposit. The supported platforms, MT4 and MT5, cater to varied trading strategies and preferences, enhancing the broker’s appeal. Valutrades offers leverage up to 500:1 and ensures clients have negative balance protection, aligning with its safety measures. With low costs and a simple account structure, FXScouts gives Valutrades a rating of 4.25 out of 5.

Is Valutrades safe?

Yes, Valutrades is a safe broker to trade with. It maintains regulation from the FCA in the UK and the FSA of Seychelles. South African traders can choose to trade with Valutrades UK or Valutrades Seychelles.

Valutrades UK or Valutrades Seychelles: When choosing between Valutrades UK or Valutrades Seychelles to trade with, remember that an account in the UK will have access to the Financial Service Compensation Scheme up to a loss of 85000 GBP. It will also guarantee negative balance protection, which means you will never owe your broker any money. However, your UK account will only allow a leverage up to 30:1. When trading in the Seychelles, you don’t have access to the FSCS and negative balance protection is not guaranteed, but your leverage can be a lot higher: up to 500:1.

Valutrades’ Trading Instruments

Valutrades’ range of financial instruments to trade is not as wide as most other brokers, with no shares nor specialty CFDs such as ETFs.Its range of financial instruments for trading includes indices, Forex and commodities.

Forex: Valutrades offers 80+ currency pairs for trading, including majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/CAD, EUR/JPY, and GBP/NZD), and exotics (EUR/NOK, USD/SEK and EUR/ZAR). This is a much broader range than is typically found at other brokers. Leverage on Forex pairs is up to 500:1.

Commodities: Valutrades offers trading on 32 commodities, whereas most brokers only offer trading on between 5 – 10. These include oil, gold, and silver. Most of the Commodity CFDs are futures. Maximum leverage on metals is 500:1.

Indices: Valutrades offers trading on a wide range of international indices, including the S&P 500, DAX 40 and FTSE 100. Some of these indices are also futures.

Besides the wide selection of Forex pairs, Valutrades has a small range of CFDs. That said, the range within each asset class is broader than for most other brokers.

Accounts and Trading Fees

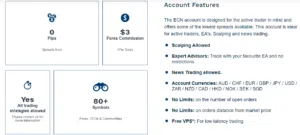

Valutrades provides one live ECN account with no minimum deposit requirements on two different platforms (MT4 and MT5), which is suitable for both beginners and more experienced traders.

No trading restrictions: Valutrades allows all trading strategies, including scalping, hedging, copy trading, and automated trading. However, it does not offer Islamic accounts (swap-free).

No minimum deposit: Valutrades’ single account requires no minimum deposit. Spreads start at 0.10 pips on the EUR/USD, some of the tightest in the industry, and a reasonable commission of 3 USD per lot per side is charged.

Deposits and Withdrawals

Overall, Valutrades offers a wider range of funding methods than most other brokers, and deposits and withdrawals are generally free.

Deposits are instant and free, except for bank wire transfers and local bank transfers, which may take one to two days to reflect in trading accounts. Withdrawals are processed within 24 hours, but a 5% fee applies from the fourth withdrawal in the same month.

No ZAR Accounts: At Valutrades, traders can choose from five base currencies through the UK-regulated entity, including AUD, USD, EUR, GBP and JPY. However, if traders choose the Seychelles-based entity, they can only select USD. Traders should consider this trade-off before selecting the entity under which they prefer to trade. South African traders using Rand-based accounts will pay currency conversion fees on all deposits and withdrawals.

- Visa/Mastercard: Card will be charged in the trading account currency, with the local currency of the card accepted.

- Maestro: Card will be charged in the trading account currency, local currency of card accepted.

- Neteller: AUD, CHF, EUR, GBP, JPY, USD & ZAR are accepted for deposits and withdrawals.

- Giropay: EUR is the only currency accepted.

- Klarna: EUR-only for deposits and withdrawals.

- Rapid Transfer (LOCAL BANK TRANSFER): GBP & EUR accepted

- Local Bank and e-wallet solution: Deposit will be charged in the trading account currency, local currency of method accepted.

There is no minimum deposit for clients to fund via bank transfer or any charges from Valutrades. However, sometimes a client may incur fees from their bank for sending a deposit to Valutrades. If you incur any fees from your bank, please email [email protected] with proof of the charge. Valutrades will then credit this amount to your trading account within 24 business hours.

Overall, Valutrades offers a wide range of funding methods. While it does not charge any fees for deposits, its does charge withdrawal fees in some cases. Be aware that even though you can make deposits in ZAR, you cannot trade with a ZAR account.

Mobile Trading Apps

With MT4 and MT5 – also available as mobile apps – Valutrades’ platform support is average compared to most other brokers.

MT4 and MT5 Apps

Valutrades offers MT4 and MT5 for both Android and iOS. Although there is slightly limited functionality compared to the desktop versions of the platforms, with reduced timeframes and fewer charting options, traders will still have access to analytics with technical indicators, graphical objects, and a full set of trading orders.

Other Trading Platforms

Valutrades offers CFD trading on MetaTrader4 (MT4) and MetaTrader5 (MT5), two of the industry’s leading platforms. Both provide automated trading systems with expert advisors (EAs) and are simple to navigate yet offer a powerful range of features, charts, and analysis tools.

The benefit of Valutrades offering third-party platforms such as MT4 and MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker. Additionally, there are thousands of plugins and tools available for the MetaTrader platforms.

MetaTrader 4

Like most other brokers, the Valutrades MT4 platform is the standard version with 24 graphical objects and 30 built-in indicators. Only the basic orders are available, Market, Limit, Stop, and Trailing Stop as well as Algorithmic trading. The MT4 platform is also fully customisable.

MetaTrader 5

MT5, the newer version of MT4, is also available at Valutrades. The difference between the two platforms is that MT4 is a Forex-only platform, while MT5 allows trading on all the assets available at Avatrade. We recommend using MT5 if you want a more powerful and faster trading platform for back-testing functionality and automated trading algorithms. Additionally, traders prefer MT5 for its depth of market display, additional technical indicators, and analytical tools.

Opening an Account at Valutrades

All South African residents are eligible to open an account at Valutrades. The account opening process at Valutrades is user-friendly and fully digital, and accounts are ready for trading within one day.

New traders click on the “Open a Live Account” button at the top of the page, where they will be directed to register an account with either Valutrades UK or Valutrades Seychelles.

Traders must fill in their details, including name, email address, physical address, date of birth, account type (leverage level), and account currency.

Valutrades requires at least two documents to accept you as an individual client.

Proof of Identification – Valutrades accepts all government-issued identification documents such as Passports, national ID cards, driving licences, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the Valutrades’ account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

After the application is approved, traders can log in and fund their accounts. We advise that you read Valutrades’ risk disclosure, customer agreement, and business terms before trading.

Research and Trading Tools

Valutrades offers a limited number of trading tools and research compared to most other brokers. However, they provide a well-organized selection of market analysis materials.

Its in-house market and research team offers various market analysis materials, including trading news and market news with commentary and updates to trading guides.

Valutrades no longer offers live webinars, but there is a resource library with all previous episodes. The webinar subjects vary from fundamental concepts like News Trading Strategies to Technical Analysis and Chart Theories like Standard Elliot Wave Models.

It also offers an economic calendar, custom indicators for MT4, and a free trading signal service, offering trading advice and opportunities via Telegram and email.

Valutrades’ Educational Material

Valutrades provides a well-organized selection of educational resources. You can find these in their Guides section.

Valutrades’ excellent written educational materials help traders develop skills to improve trading performance. Several guides have been compiled and cover topics ranging from beginner forex tips to trading strategies.

The blog posts cover trading strategies, updates on new trading products and services, news commentary, and updates to guide your trading.

Valutrades offers a range of videos, all available for free on its YouTube channel. Video tutorials cover various topics, including Forex Trading, Market Analysis, Trading Psychology, Trading Strategies, MT4/MT5 indicators, and CFDs.

You’ll also find excellent trading guides that cover the basics of Forex trading, in addition to risk management and How to Develop a Forex Trading Plan, among others.

Customer Service

Customer support is available during business hours, five days a week, via email, live chat, and telephone in Chinese, English, and Portuguese. Telephone support is only available through its UK office.

Regulation and Trust

Founded in 2012 and headquartered in London, Valutrades Limited is a limited liability company registered in England and Wales with its registered office at 51 Eastcheap, London, EC3M 1JP, United Kingdom. Company Number 07939901. Valutrades Limited is authorised and regulated by the Financial Conduct Authority. Financial Services Register Number 586541.

VALUTRADES (SEYCHELLES) LIMITED is a limited liability company registered in the Republic of Seychelles with its registered office at F20, 1st Floor, Eden Plaza, Eden Island, Seychelles. VALUTRADES (SEYCHELLES) LIMITED is authorised and regulated by the Financial Services Authority of the Seychelles. Securities Dealer License No SD028.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker’s platform offering, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Valutrade’s Risk Warning

Trading Forex is risky, and each broker is required to detail the possible consequences the trading of Forex CFDs can bring to clients. Valutrades would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Final Word

Valutrades is a dependable, well-regulated ECN broker. Whilst non-forex products may be limited, Valutrades offers a single live account with no minimum deposit, tight spreads, and low commissions on the MT4 and MT5 platforms. The well-organised selection of educational and research materials makes it an accessible broker for beginners.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Valutrades stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.