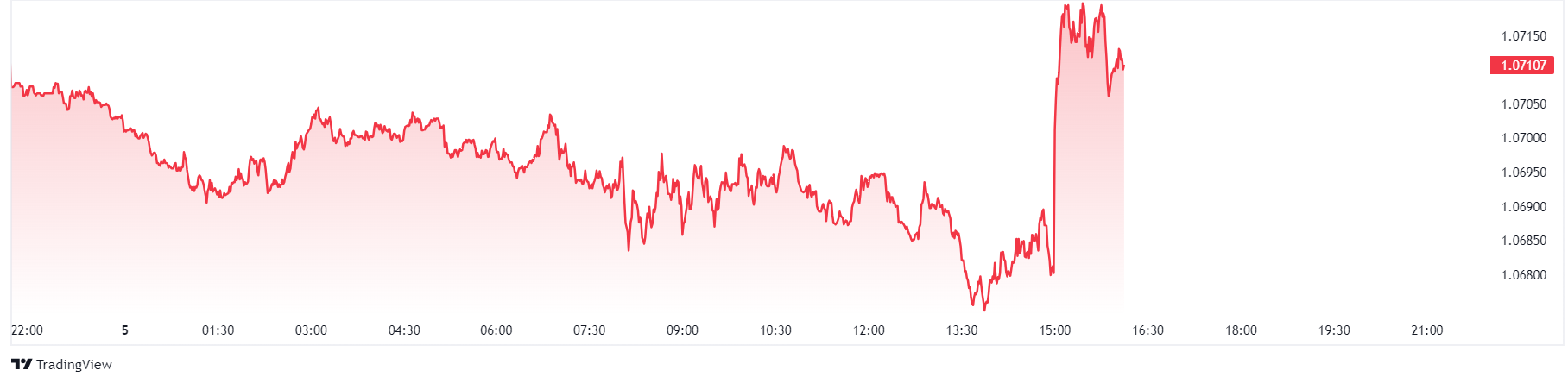

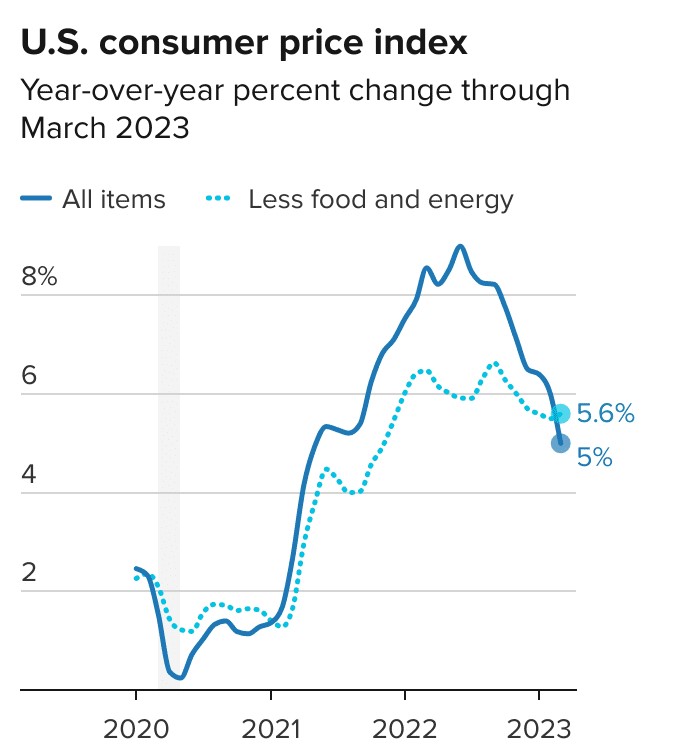

Trump and falling inflation push gold to a new all-time high

Chris CammackJuly 18, 2024 02:27 PM

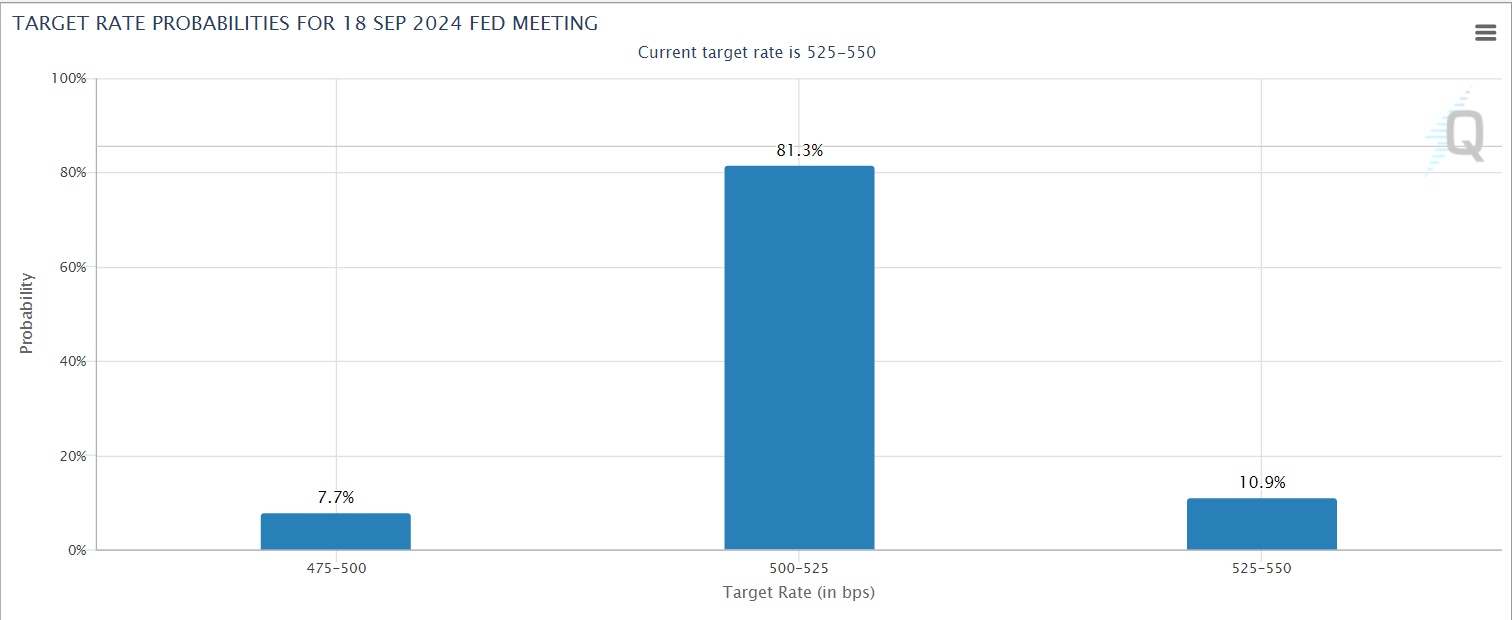

With interest rates now likely to come down at least twice and possibly three times this year - and Biden’s bid for a second term looking weaker than ever - gold prices are likely to remain elevated.